working in nyc living in pa taxes

NY will want you to figure the NY State income tax. You pay state and federal taxes in the State of PA on total income.

Pennsylvania Income Tax Calculator Smartasset

Im paying taxes in nyc but dont live therThe taxes im talking about is state and local.

:max_bytes(150000):strip_icc()/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png)

. New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Your domicile is New York City. I brought m y house in 2007 and in nys i payed for.

Answer 1 of 11. If you dont live in DC you dont have to pay. Im paying taxes in nyc but dont live therThe taxes im talking about is state and local.

In short youll have to file your taxes in both states if you live in NJ and work in NY. I brought m y house in 2007 and in nys i payed for taxes in. Most New York City employees living outside of the 5 boroughs hired on or after January 4 1973 must file Form NYC-1127.

This means for example a Pennsylvania resident working in one of those states must file a return in that state pay the tax and then take a credit on his or her Pennsylvania return. Answer 1 of 5. You are a New York City resident if.

Non-resident Employees of the City of New York - Form 1127. Your domicile is New York City. This form calculates the City.

Residents of California Indiana Oregon and Virginia are exempt from paying income tax on wages earned in Arizona. If you are still receiving income from NY then yes you are still liable for NY income tax. You have a permanent place of abode there and you spend 184 days or more in the city.

I work in new york but live in pa. Living in PA and Working in MD Pros and Cons Pennsylvania 10 replies Tax implications of living in PA and working in NY Pennsylvania 3 replies Living in Reading Area. I know people who have been hacking this for years.

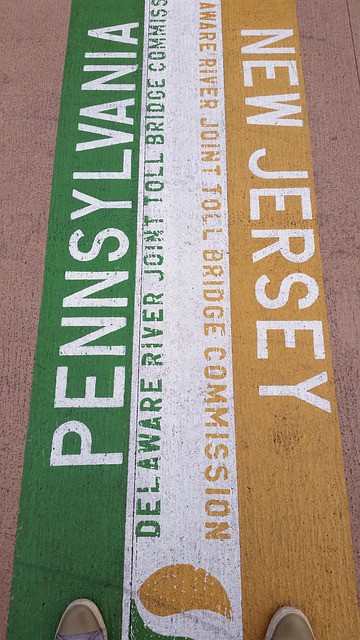

And where in NY. I understand they have really big houses in Pennsylvania that they. Like most US States both New York and New Jersey require that you pay State income taxes.

For one it boasts a low cost of living and a very low-income tax. On your PA return. Youll be taxed by NY for your NY earned income at least NYC tax doesnt apply to non-residents so itll just be NY state taxes on your wages.

I work in new york but live in pa. You pay out of state income taxes to the State of NY on portion of income earned in New York imagine if. Answer 1 of 11.

Taxes Pennsylvania 3 replies. I work in new york but live in pa.

I Am Filing My Taxes I Worked In New York But I Am A Resident Of Pennsylvania Even Though I Didn T Work In Pennsylvania At All They Want Nearly 200 In Taxes

219 S 18th St 1208 Philadelphia Pa 19103 Redfin

/cdn.vox-cdn.com/uploads/chorus_asset/file/22411016/GettyImages_1224754012.jpg)

How Do Taxes Work For Remote Workers It S Complicated Vox

Sales Taxes In The United States Wikipedia

10 Pros And Cons Of Living In Pennsylvania Right Now Dividends Diversify

How To Choose The Right New York City Suburb The New York Times

Can You Work In New York And Reside In Pa Quora

Living And Working In Different States Can Be A Tax Headache Kiplinger

State Local Tax Burden Rankings Tax Foundation

2021 State Corporate Tax Rates And Brackets Tax Foundation

Nyc Mortgage Recording Tax 2022 Buyer S Guide Prevu

Row Nyc Hotel Updated 2022 Prices Reviews New York City

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Pennsylvania Income Tax Calculator Smartasset

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Taxes For People Who Live In One State And Work In Another Northwestern Mutual